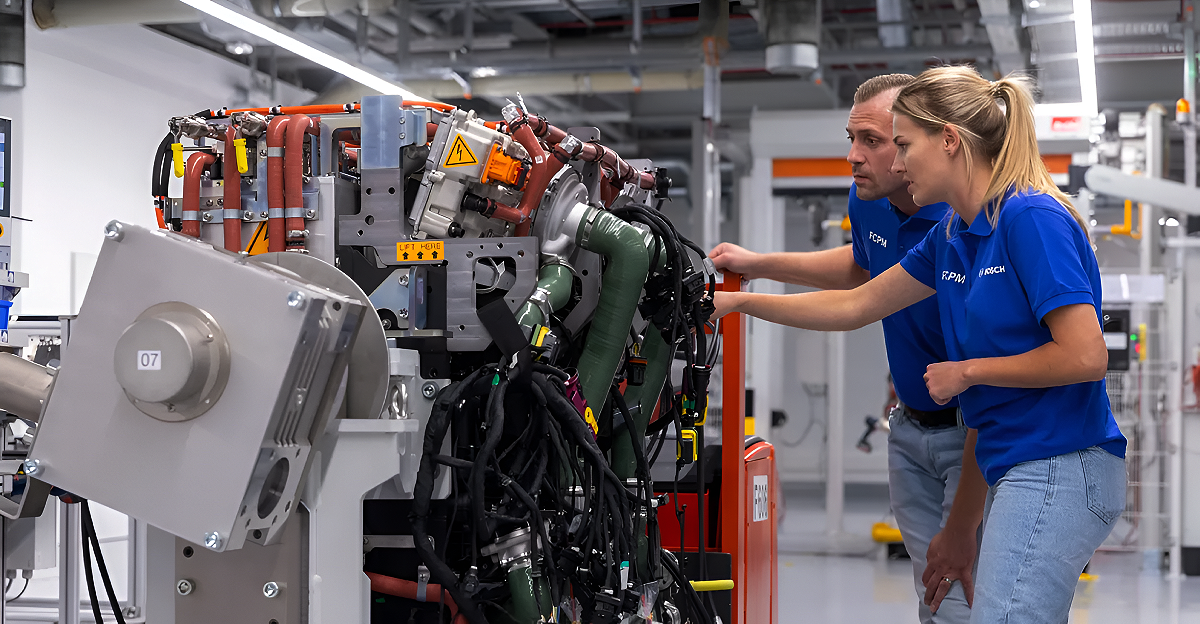

Bosch, the world’s largest auto supplier, plans to cut 13,000 jobs, raising alarms in Germany’s automotive sector.

This decision comes amid growing economic pressures and declining demand in Europe, marking one of the largest workforce reductions in recent years and prompting concerns about the future of auto manufacturing in Germany.

Industry-Wide Crisis

Bosch is among several major automakers in Germany announcing layoffs, with Schaeffler cutting approximately 4,700 jobs and Continental eliminating 7,150 positions.

Volkswagen plans to reduce its workforce by 35,000 by 2030. These job cuts reflect rising competition from Chinese manufacturers and Europe’s slow shift to electric vehicles, posing a threat to Germany’s automotive leadership.

Historical Context

Bosch is a key player in Germany’s industrial sector, supplying parts to global automakers. However, it has faced challenges like declining demand and changing consumer preferences.

In 2024, Bosch announced 9,000 layoffs, highlighting deeper structural issues in the industry.

Global Market Pressures

The automotive market is facing significant challenges, with Asia now accounting for over 60% of global car production.

In 2025, China’s vehicle output surged by 12%, while European production declined by 2.6%. Factors such as high energy costs, stricter CO2 targets, rising tariffs, and economic uncertainty are constraining consumer demand across key markets.

Cutting Jobs

On September 25, 2025, Bosch announced plans to cut around 13,000 jobs, mainly in its automotive division, by 2027. This reduction will impact about 10% of its German workforce and 3% globally.

The company aims to save €2.5 billion annually in response to ongoing industry challenges and shifting consumer demand.

Regional Impact

Job cuts at Bosch will significantly impact several German regions, including Stuttgart-Feuerbach (3,500 jobs), Schwieberdingen (1,750), Waiblingen and Bühl (1,550), and Homburg (1,250).

These areas are home to Bosch’s Power Solutions and Electrified Motion divisions, and local economies dependent on automotive manufacturing are bracing for economic challenges due to the restructuring.

Union and Worker Response

Workers’ representatives have condemned the layoffs as “unprecedented.” Frank Sell, head of Bosch’s works council, pledged to vigorously oppose the cuts, while IG Metall’s Adrian Herms called it a “pitch-black day for social partnership.”

Negotiations are anticipated to be contentious, with the council pushing for voluntary arrangements and job security guarantees through 2027.

Financial Performance Breakdown

Bosch’s mobility division is facing declining profit margins due to stagnant automotive sales. In 2024, global supplier margins have dropped to 4.7% EBIT, down from pre-COVID levels, with European suppliers lagging at 3.6%.

They are also experiencing heightened cost pressures from OEMs and rising development costs for electric vehicle components, which further impact their profitability.

Supplier Squeeze

A recent supplier study indicates that German auto suppliers have grown at an annual rate of 5.7% since 2020, while Chinese suppliers have expanded by 14.7%.

Automakers are increasingly bringing value creation in-house, limiting opportunities for traditional suppliers like Bosch. This trend of vertical integration intensifies competition and accelerates the restructuring of supply chains.

Electric Vehicle Transition Struggles

Bosch’s substantial investments in electric vehicle components have not yet produced the expected returns, with EV adoption in Europe lagging behind projections.

Meanwhile, Chinese manufacturers lead in battery technology and electric drivetrains. Additionally, Bosch’s hydrogen fuel cell investments face challenges as the technology struggles to gain widespread acceptance in the mainstream automotive sector.

Leadership Response

Stefan Grosch, Bosch’s Chief Human Resources Officer, stated, “We urgently need to work on our competitiveness.”

CEO Stefan Hartung described 2025 as a “challenging year,” emphasizing the need for permanent cost reduction and increased competitiveness to close the gap with global rivals. The leadership team faces pressure from shareholders to accelerate transformation.

Technology Investment Strategy

Despite layoffs, Bosch continues to make substantial R&D investments, spending €7.8 billion in 2024. Focus areas include software-defined vehicles, artificial intelligence for manufacturing, and the production of silicon carbide semiconductors.

The company’s AI Academy has trained over 65,000 employees, with nearly 5,000 AI specialists working on intelligent solutions across divisions.

Competitive Landscape Analysis

Bosch faces intensifying competition from Chinese suppliers, as well as achieving higher growth rates and tech companies entering the automotive market. Chinese automotive suppliers maintain EBIT margins of 5.7% compared to European suppliers’ 3.6%.

Tesla’s vertical integration model and aggressive pricing from Asian competitors have eroded traditional supplier relationships and margins.

Manufacturing and Investment Shifts

Bosch is consolidating its European operations while investing heavily in strategic locations. The company plans to invest $1.9 billion in its Roseville, California, semiconductor facility and has invested over $2 billion in U.S. operations over five years.

Production shifts to lower-cost regions continue as competitiveness pressures mount.

Skills Gap and Workforce Transformation

The automotive industry faces a critical skills mismatch as traditional mechanical engineering becomes less relevant while software expertise becomes essential.

Bosch has committed €2 billion to retraining programs for a portion of its 400,000 global workforce, focusing on transitioning combustion engine specialists to electric vehicle technologies.

Regulatory and Trade Pressures

EU CO2 reduction targets for 2025 compel automakers to accelerate the adoption of zero-emission technology or face penalties. Rising trade tensions with China and potential tariffs on automotive imports add complexity.

U.S. tariff policies could disrupt the $98.9 billion in vehicle imports and $82.5 billion in auto parts from Mexico alone.

Capital Market and Liquidity Concerns

Approximately 31% of public automotive company debt, totaling $36 billion, matures in 2025, creating liquidity pressure.

Credit rating agencies warn of potential downgrades if companies cannot stabilize margins. Bosch’s restructuring announcement initially boosted investor confidence, with analysts viewing cost cuts as necessary for long-term competitiveness.

Government Policy Response

German policymakers are debating emergency support for the automotive sector, including accelerated depreciation for EV investments and expanded worker retraining programs.

Chancellor’s office sources suggest potential state aid for strategic suppliers, though EU competition rules limit direct intervention. Regional governments are negotiating retention packages for threatened facilities.

Supply Chain Implications

Bosch’s restructuring will ripple through hundreds of smaller suppliers and service providers across Germany. Tier 2 and Tier 3 suppliers face contract cancellations and volume reductions.

The disruption threatens entire industrial clusters in Baden-Württemberg and Bavaria, where automotive supply chains have operated for decades.

Industry Transformation Timeline

Industry analysts project significant consolidation in Germany’s automotive supplier landscape by 2030, with only the most innovative companies expected to survive the transition.

Bosch’s moves signal the beginning of a three-year restructuring wave across the European automotive industry. Success will depend on rapid adaptation to electrification, software-defined vehicles, and new mobility services, rather than relying solely on traditional engineering excellence.