UnitedHealth Group, America’s largest health insurer, announced the planned disenrollment of roughly 1 million Medicare Advantage members for the 2026 enrollment period. This marks the largest single-insurer exit in more than 20 years. Members, families, and providers are facing immediate disruption.

The decision follows margin pressures, provider network issues, and federal regulatory changes. With implementation starting in January 2026, the effects will be felt by seniors, hospitals, brokers, and small businesses. Here’s what’s going on behind the most significant Medicare Advantage shake-up in decades.

Who Is UnitedHealth Targeting?

UnitedHealth covers over 8.4 million Medicare Advantage members and ranks among the Fortune 10. CEO Tim Noel formally announced the cuts on the Q3 2025 earnings call. CFO Wayne DeVeydt described the move as a return to “swagger” at the UBS Healthcare Conference.

Affected parties include employees, brokers, providers, and about 1 million seniors. Small businesses and caregivers are also affected as disrupted coverage forces them to navigate through alternative plans. But what drove this unprecedented withdrawal?

What Exactly Is Happening?

UnitedHealth plans to disenroll 1 million members from PPO, group, and D-SNP plans in counties with declining profitability or operational challenges. This exceeds Humana’s 2024–2025 cut of 560,000 members, making it the largest single-insurer reduction in decades.

The move is part of a broader industry contraction, with CMS projecting MA enrollment to drop nationally from 35 million to 34 million in 2026. Could this signal similar moves by other insurers?

Breakdown Of The Exits

Roughly 600,000 members are being removed from PPO plans, 200,000 from group retiree and public sector arrangements, and 200,000 from D-SNP and other plans. Counties with the steepest financial pressure see the largest cuts.

These reductions are concentrated geographically, but UnitedHealth remains present in most major markets. Competitors like Aetna and Humana are also trimming offerings, hinting at a nationwide trend of MA contraction.

Why UnitedHealth Made The Move

Margins for UnitedHealth’s Medicare products dropped from 5.6% to 2.1% in 2024–2025, while Optum margins fell from 8.3% to 1% following cyberattacks and regulatory pressures.

Operationally, hospitals, including Mayo Clinic and Johns Hopkins, exited MA networks due to frequent denials, reducing coverage availability. Regulatory changes, such as CMS “Star” ratings, further pressured lower-performing plans. But how did leadership explain this tough decision?

Leadership Speaks Out

“This was a very difficult decision, but necessary to sustain our ability to provide competitive, high-value coverage in a fast-changing Medicare environment.” —Tim Noel, CEO, UnitedHealthcare, Q3 Earnings Call, 28 October 2025.

CFO Wayne DeVeydt added, “Many of the changes UnitedHealth is making will allow it to get back to the swagger the company once had.” —UBS Healthcare Conference, 11 November 2025. These statements underline a strategic pivot amidst financial and operational pressures.

When Did The Announcement Happen?

UnitedHealth disclosed the cuts during its Q3 2025 earnings call on 28 October 2025. The reductions will take effect for the 2026 Medicare Advantage open enrollment period, which covers October–December 2025, with coverage starting January 1, 2026.

The company had previously projected a 600,000-member cut in July 2025, escalating to 1 million by late October. Could prior warning have prepared members for such a large-scale shift?

Where Are The Cuts Concentrated?

Cuts target counties with financial losses or operational problems, including rural and suburban areas. Some entire counties are exiting PPO and group plans, while UnitedHealth maintains a presence in major metropolitan markets.

This mirrors competitor strategies. For example, Aetna is exiting all of Wyoming and over 100 counties nationally. The industry’s contraction may reshape access to Medicare Advantage for many seniors.

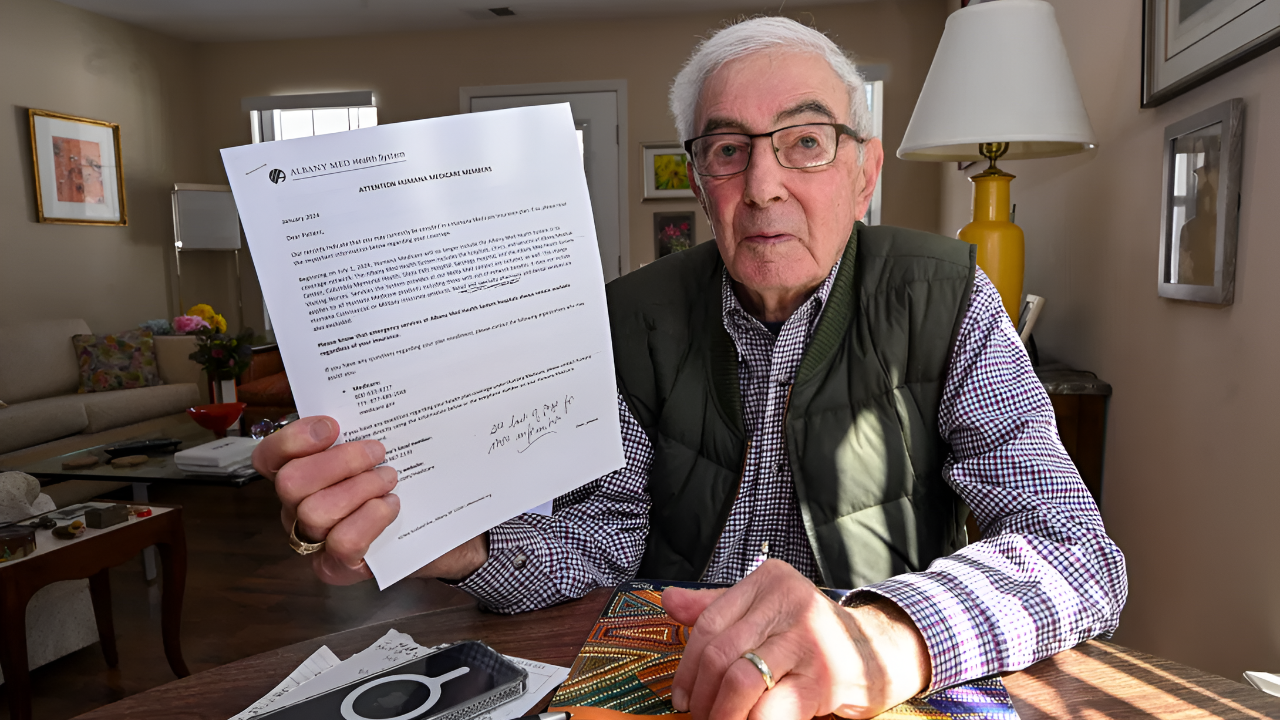

How Members Are Being Notified

UnitedHealth is sending letters and digital notices to affected policyholders, outlining alternative plans, timelines, and next steps. Communication aims to guide seniors through necessary transitions to maintain coverage.

Special Enrollment Periods from CMS allow members to select new MA plans or return to traditional Medicare. Insurance brokers and care navigators are facing heightened workloads to support these transitions. Will members find suitable alternatives quickly?

Impact On Providers And Networks

Hospitals and clinicians must revalidate or sever contracts due to plan exits, further limiting available networks for patients. This affects major providers, including Mayo Clinic and Johns Hopkins.

Network disruptions may strain both patient care and operational planning. Providers must adapt to shifting coverage landscapes while ensuring compliance and continuity. The broader ripple effect is now emerging across the healthcare system.

Financial Stakes For UnitedHealth

Each Medicare Advantage member represents an estimated annual premium of $10,000–$15,000. UnitedHealth’s 1 million-member exit could translate to $10–$ 15 billion in potential revenue loss, although exact figures remain undisclosed.

Profit recovery drives this decision, but operational and regulatory pressures compound the stakes. The financial calculus highlights why large-scale cuts were deemed necessary. How might this affect future profitability?

Effect On Seniors And Families

About 1 million seniors lose MA coverage, indirectly affecting 2–3 million people, including spouses and caregivers. These households must secure alternative plans, navigate coverage gaps, and adjust to new provider networks.

The human impact is immediate and tangible, affecting millions of Americans who rely on Medicare Advantage. The broader societal impact could ripple into caregiving, financial planning, and challenges to healthcare access.

Implications For Brokers And Agencies

Insurance brokers, plan agents, and care managers face increased workloads guiding seniors through plan comparisons and new enrollments. Delays or confusion could impact client satisfaction and revenue streams.

Smaller agencies may feel particular strain as they adapt to sudden shifts. Industry observers note that this surge could alter the competitive dynamics in MA brokerage markets, prompting rapid operational adjustments.

Small Business And Supply Chain Disruption

Vendors and technology platforms supporting Medicare Advantage plans may experience client loss or revenue decline due to UnitedHealth’s pullback. Hospitals, pharmacies, and software providers face similar operational disruptions.

The cascading effects may alter regional healthcare ecosystems, highlighting the interconnected nature of MA products. What happens next for companies dependent on UnitedHealth contracts and member volumes?

Industry-Wide Significance

This is the largest single-insurer Medicare Advantage reduction in more than 20 years. CMS projects the first national MA enrollment decline from 35 million to 34 million members in 2026.

Competitors like Humana and Aetna are also reducing their MA footprint, showing this is not an isolated event but a signal of systemic industry retrenchment.

Historical Perspective

No single carrier has exited more members in a single year since the early 2000s, when multi-insurer withdrawals cumulatively affected over 2 million enrollees. UnitedHealth’s move sets a new benchmark for scale.

The precedent raises concerns about stability in Medicare Advantage markets. If reimbursement pressures persist, other insurers may follow suit, reshaping coverage availability nationwide.

Regulatory Context

CMS quality metrics, including “Star” ratings and stricter reimbursement rules, penalize lower-rated plans and pressure margins. The “two-midnight rule” and other compliance measures further strain insurers’ profitability.

Federal oversight aims to protect beneficiaries, but rigid regulations may accelerate plan exits. Policymakers now face a challenge balancing quality enforcement with market stability.

Operational Challenges Driving Change

Provider withdrawals, high denial rates, and cyberattack fallout have disrupted plan operations. This has increased costs and damaged public perception, contributing to UnitedHealth’s decision.

Operational instability adds to financial pressures, creating a feedback loop. Streamlined networks and reduced plan offerings are now central to restoring corporate margins and operational confidence.

Future Risks For Medicare Advantage

Experts warn UnitedHealth’s exit could trigger further MA contraction unless federal reimbursement models or risk adjustments evolve. Coverage gaps may increase if insurers continue similar strategies.

Policymakers, providers, and insurers must work together to maintain access and prevent destabilizing senior healthcare. The 2026 enrollment period will test the resilience of the MA system under these pressures.

Key Takeaways And Next Steps

UnitedHealth’s 1-million-member disenrollment is a watershed moment for Medicare Advantage, exposing profit, regulatory, and operational vulnerabilities. Seniors, providers, and brokers must navigate a complex landscape.

This episode highlights the fragility of the current MA model and may prompt urgent policy adjustments. The coming months will reveal whether other insurers follow, reshaping Medicare coverage across the nation.