America’s retail sector confronts unprecedented challenges as major chains announce widespread closures. Industry analysts project 15,000 store shutdowns in 2025, according to Coresight Research, representing double last year’s 7,300 closures. Economic pressures from inflation and rising interest rates squeeze traditional retailers while online shopping continues its relentless advance. However, specific segments like pet care navigate these turbulent waters with varying degrees of success.

Consumer Shopping Habits Permanently Altered by Digital Revolution

The pandemic fundamentally transformed how Americans shop, with e-commerce capturing larger market shares across most retail categories. UBS Investment Bank data reveals that traditional brick-and-mortar stores now struggle against online convenience, personalized recommendations, and competitive pricing. Yet specialty retailers serving emotional needs demonstrate surprising resilience. The critical question becomes which companies can adapt their business models fast enough to survive this transformation.

Pet Industry’s Historical Resilience Faces New Challenges

Pet retail has traditionally weathered economic downturns better than most sectors due to the unbreakable bonds between owners and their beloved animals. The American Pet Products Association reports the U.S. pet industry reached $147 billion in 2023, reflecting decades of steady growth where spending often increases during recessions as pets provide emotional comfort. Two dominant chains now control most specialty pet retail traffic nationwide, creating fierce competitive pressure for market share.

Rising Costs Create Perfect Storm for Physical Retailers

Operational expenses continue climbing as labor costs, commercial rents, and supply chain disruptions hammer retailer profitability. Placer.ai research shows that Amazon and Chewy have captured significant online market share, forcing traditional stores to compete simultaneously on convenience and pricing. Physical retailers face the daunting challenge of convincing customers to visit stores when identical products arrive via free shipping with subscription services from their couches.

Pet Giant Announces Strategic Store Closures Across America

Petco Health and Wellness Company revealed plans to close approximately 25-30 stores during fiscal 2025 permanently, CEO Joel Anderson announced during the August 28 earnings call. The closures follow 25 store shutdowns in 2024, bringing total planned reductions to over 50 locations across two years. Anderson describes these moves as “Phase 2” operational restructuring designed to improve profitability before pursuing aggressive growth initiatives.

Communities Across Multiple States Face Store Losses

Pet owners in affected communities will lose convenient access to specialized products and services as Petco optimizes its 1,363-location network. ScrapeHero location data indicates the targeted stores represent underperforming locations that fail to meet profitability thresholds in Anderson’s comprehensive strategic review. Rural and suburban markets with lower population density face higher closure risks as the company prioritizes maximum efficiency over geographic coverage.

Employees Express Uncertainty About Job Security and Future

Sources close to the situation report that workers at affected locations worry about job security and transfer opportunities within the company’s remaining network. Store employees fear losing years of built relationships with loyal customers and their pets. “The first half of this year established a solid foundation for our transformation as we strengthened our economic model,” Anderson stated during the Q2 earnings call. However, specific details regarding employee support remain unclear.

Competitive Pressure Intensifies as Market Leaders Battle

Placer.ai analysis reveals that PetSmart maintains commanding market leadership with 62.1% of specialty pet retail foot traffic compared to Petco’s 37.9% share. Online competitors Amazon and Chewy steal market share from physical chains through convenient subscription services and aggressive pricing strategies. Traditional grocery chains and big-box retailers have also expanded pet product selections, intensifying the battle for pet owner spending.

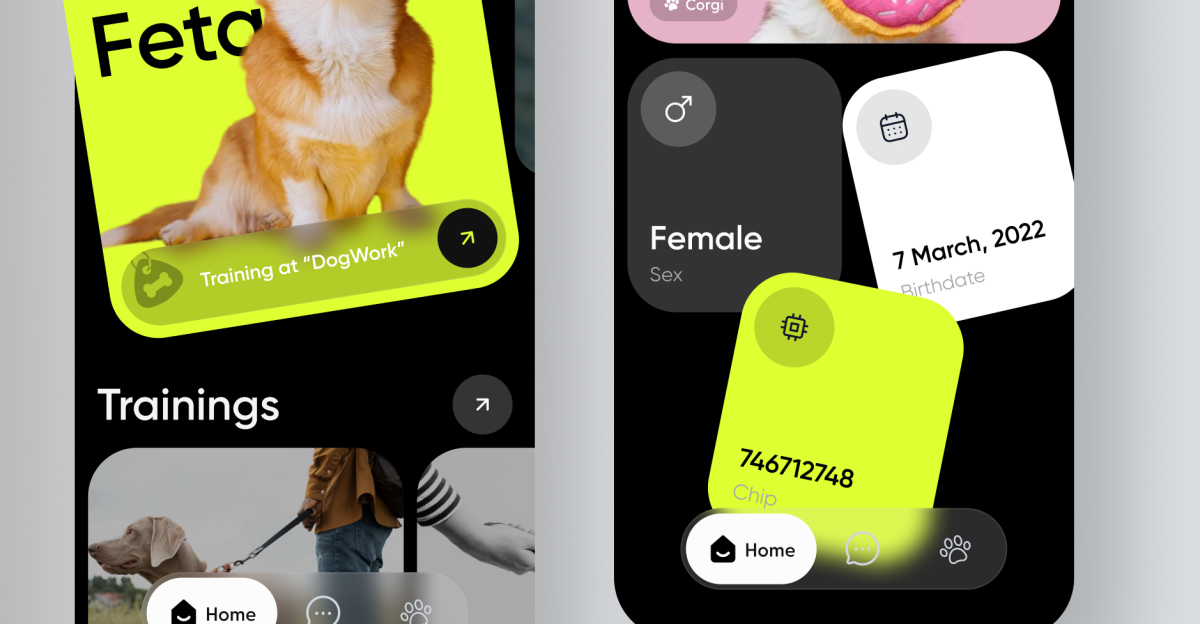

Digital Disruption Reshapes Pet Shopping Forever

The pet industry mirrors broader retail transformation. Online channels captured 36% of pet food sales in 2021, with projections reaching 54% by 2025. Packaged Facts research indicates subscription-based auto-ship programs from Chewy and Amazon provide convenience that physical stores struggle to match. Brick-and-mortar pet retailers must completely reinvent their value proposition beyond simple product distribution to justify their continued existence in pet owners’ lives.

Financial Performance Improves Despite Fewer Stores

Petco reported dramatically improved financial metrics with adjusted EBITDA jumping 36.4% to $113.9 million in Q2 2025, company filings show. Operating income surged $40.6 million while profit margins expanded 120 basis points to 39.3% through strategic cost reductions. The company raised full-year earnings guidance, demonstrating that fewer, more profitable locations can generate superior returns than maintaining extensive but underperforming networks that drain resources.

Internal Disagreements Surface Over Transformation Pace

Corporate sources suggest that board discussions revealed some internal stakeholders questioned the pace and scale of Anderson’s transformation plan. Certain executives advocated more aggressive digital investments than physical store optimization strategies. Anderson’s previous success expanding Five Below from 361 to 1,600 stores creates expectations for eventual growth, but current market conditions demand defensive positioning before any expansion dreams can materialize.

New Leadership Brings Decades of Retail Transformation Experience

Joel Anderson joined Petco as CEO in July 2024, bringing three decades of retail experience from Walmart.com, Five Below, and other major chains. Corporate announcements confirm that his appointment followed interim leadership after the previous CEO’s departure in March 2024. Anderson restructured the executive team with new appointments for CFO, Chief Stores Officer, and other key positions to execute his comprehensive transformation vision.

Three-Phase Recovery Plan Emphasizes Fundamentals Before Growth

Anderson explained at the Goldman Sachs Retailing Conference that Petco’s strategic transformation plan emphasizes improving retail fundamentals before pursuing growth initiatives planned for 2026. Phase 2 focuses on cost discipline and operational efficiency through store optimization and vendor renegotiations. Phase 3 will emphasize enhanced store experiences, merchandise differentiation, expanded services, and omnichannel capabilities to compete effectively with digital-native competitors.

Industry Experts Question Long-Term Viability Strategy

UBS Investment Research notes that analysts are skeptical about whether physical pet retailers can successfully compete against e-commerce convenience and subscription services long-term. Some experts doubt Anderson’s timeline for returning to growth, given persistent headwinds from inflation, consumer debt, and relentless digital disruption. However, veterinary services and hands-on experiences provide differentiation that online competitors cannot easily replicate through technology alone.

Critical Questions Emerge About Physical Retail’s Future

Will Petco’s transformation strategy prove sufficient to compete in an increasingly digital pet retail environment where convenience and pricing dominate consumer decisions? Global Pet Industry analysis suggests the company’s ability to balance cost reduction with investment in differentiating services will determine whether physical pet stores remain relevant to pet owners’ lives. Success requires proving that in-person expertise and pet services justify higher prices than convenient online alternatives.

Trade Policy Uncertainties Complicate Industry Planning

Washington Post analysis warns that rising tariff costs on imported pet products could further pressure retailers’ profit margins and accelerate store closures across the industry. Trade policy uncertainties complicate long-term planning as companies struggle to predict cost structures and pricing strategies in an unstable environment. Regulatory changes in pet healthcare and e-commerce taxation may dramatically reshape competitive dynamics between online and physical retailers.

Global Retail Transformation Mirrors American Challenges

Global Logic reports indicate that European pet retailers face similar digital disruption pressures as online platforms gain market share across multiple countries. British and German chains implemented comparable store optimization strategies to maintain profitability amid rapidly changing consumer behaviors. Global pet industry consolidation continues as companies desperately seek economies of scale to compete with technology-enabled competitors and subscription-based business models.

Store Closures Trigger Complex Legal and Labor Considerations

Legal experts note that company announcements trigger employee notification requirements under federal and state WARN Act provisions for mass layoffs. Labor relations become critical as companies balance cost reduction needs with maintaining workforce morale during difficult transitions. Real estate lease obligations and landlord negotiations complicate closure timing and significantly impact quarterly results that investors scrutinize closely.

Pet Humanization Trends Create New Opportunities and Challenges

Pet humanization trends drive premium spending on specialized services and products that favor experiential retailers over simple product distributors, according to Pet Industry Market Analysis research. Younger generations view pets as genuine family members, creating opportunities for businesses providing comprehensive care rather than transactional relationships. Social media amplifies pet culture, influencing purchasing decisions through powerful emotional connections that transcend traditional price-based competition strategies.

Industry Transformation Signals Broader Retail Evolution

Economy Insights analysis suggests that Petco’s strategic restructuring reflects fundamental shifts in American retail, where physical presence must justify existence through unique value creation rather than convenience alone. The pet industry’s relative recession-resistance cannot protect individual companies from operational inefficiencies and strategic missteps in rapidly evolving markets. Success increasingly depends on balancing digital capabilities with irreplaceable human expertise and emotional connections that define modern pet ownership culture in America.