Once revered as San Francisco’s premier shopping destination, the San Francisco Centre has spiraled into a striking example of urban decline. Over the past seven years, it has plummeted from a valuation of $1.2 billion to just $195 million, losing more than $1 billion in value. With 93% of its 1.4 million square feet now vacant, this fall represents one of the most severe retail collapses in recent American history.

The Perfect Storm Behind the Disaster

A convergence of disruptive forces has contributed to this unprecedented decline. The COVID-19 pandemic emptied downtown office spaces, decimating foot traffic at the mall. Rising retail crime and safety concerns, coupled with broader urban challenges in San Francisco, accelerated tenant departures.

The departures of anchor stores like Nordstrom and Bloomingdale’s created a domino effect, sealing the mall’s fate.

Shoppers Abandoned in the Void

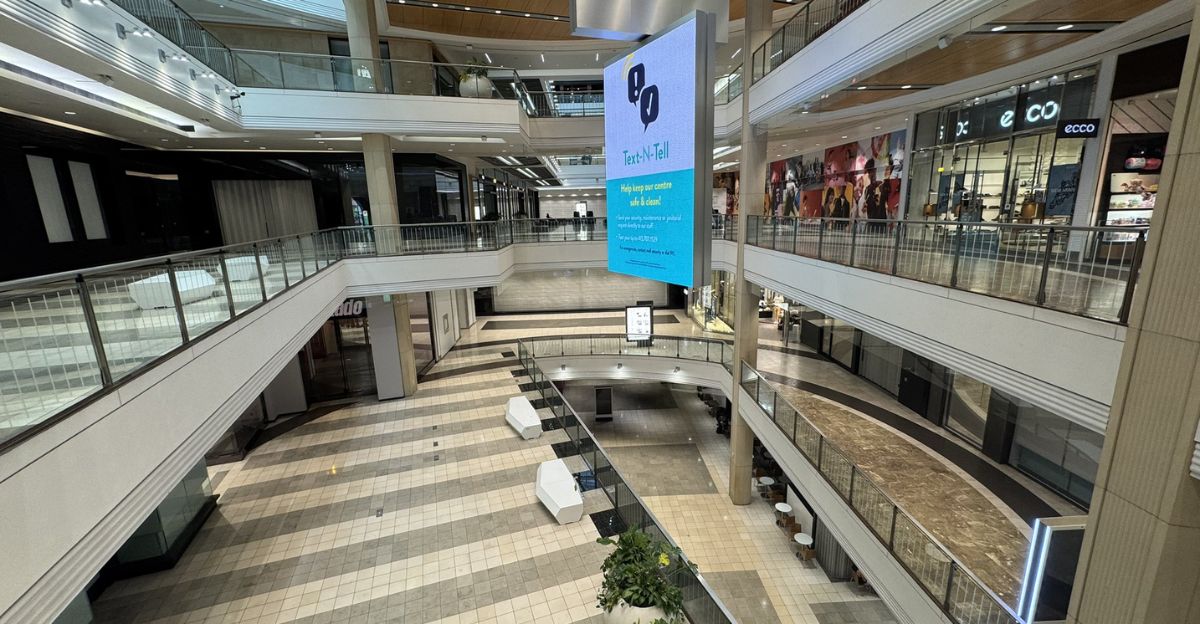

For local consumers, the mall now resembles a retail wasteland. Longtime patrons describe the unsettling experience of wandering through eerily empty floors in search of essentials. Security personnel outnumber customers, fostering an atmosphere reminiscent of a ghost town rather than a vibrant shopping hub.

Corporate America’s Swift Exodus

The speed with which major retailers exited San Francisco Centre has left industry observers reeling. High-end brands, including Rolex, Coach, Kent Spade, and Bloomingdale’s—abandoned their leases, some with decades left on the contracts. Retail expert Mark Steiner remarked that he’d “never seen a shopping center of this size die so quickly,” labeling it “unprecedented” in major markets.

Commercial Real Estate Markets Recoil

The ramifications of the mall’s fall are echoing through commercial mortgage-backed securities markets. The $558 million mortgage tied to the property is divided among five CMBS deals, spreading losses across institutional investors nationwide. Special servicers are racing to manage the repercussions of one of the largest retail loan defaults in recent memory, with foreclosure imminent.

International Retail Chains Reassess American Exposure

The collapse has prompted global retail giants to reevaluate their urban strategies in the U.S. Former owners Unibail-Rodamco-Westfield and Brookfield Properties opted to walk away from their $558 million mortgage in 2023, citing the harsh operating environment in downtown San Francisco.

International luxury brands that once viewed American cities as prime locations are now questioning their urban investments.

The Human Cost of Retail Collapse

Beneath the staggering statistics lie the personal stories of those affected by the mall’s decline. Sam Argueta, aged 66, has watched his shoe repair business shrink from five employees to just himself. Lacking the means to relocate, he anticipates closure, resignedly stating, “I know the end is coming one of these months.”

Political Scrambling for Solutions

In response to the crisis, Mayor London Breed has proposed various ideas for repurposing the mall, including transforming it into a soccer stadium or lab space. This political scrambling reflects a larger municipal panic over downtown revitalization, as city officials grapple with the systemic issues that laid the groundwork for such a notable retail collapse.

Broader Economic Ripples Through San Francisco

The mall’s failure has intensified the economic challenges facing San Francisco. It has further entrenched negative perceptions of the city’s business climate, creating a vicious cycle where every closure makes it harder for remaining businesses to recover. This trend has led to decreased foot traffic and diminishing tax revenues for the city.

Food Service Industry Devastation

Once a lively hub of commerce and community, the mall’s food court lost six restaurants just in the summer of 2025. The few remaining establishments struggle with drastically reduced patronage as the shopping center shifts from a vibrant locale to a hollow shell, further highlighting the shift away from in-person dining and retail in urban areas.

Security and Service Industries Contract

The grand decline of San Francisco Centre has had a crippling effect on associated service providers. From chair massage services to cellphone repair kiosks, many businesses have vanished along with the foot traffic. Security companies now face the irony of needing more personnel to patrol empty spaces while having fewer tenants to cover their costs.

Technology and Gaming Retail Retreat

Even retail focused on technology has suffered. Gaming firm Razer closed its downtown computer store, redirecting customers to its locations in San Jose. The shift underscores the broader struggles facing tech retail, as remote work limits the customer base for specialized urban storefronts.

Shifting Consumer Behavior Patterns

The mall’s demise highlights fundamental shifts in consumer behavior. Increasingly, shoppers prefer quick, convenient trips over lengthy stays at shopping centers—a transition hastened by the pandemic. Even with restrictions lifted, many individuals have not reverted to their pre-2020 shopping habits, dramatically reshaping the retail landscape.

Urban Safety Perceptions Transform Shopping

Rising concerns over retail crime have transformed how consumers perceive safety when shopping. In a notable legal action, American Eagle sued the mall’s operators in 2023, citing unsafe conditions after more than 100 reported security incidents. These safety concerns created a negative feedback loop, where diminished shopper presence led to less perceived security, prompting further reluctance to visit.

Cultural Symbol of Urban Decline

Once celebrated for its spiral escalator, a hallmark of retail innovation and urban elegance, the mall now serves as a symbol of decline and desolation.

Social media showcases eerie images of the nearly vacant space, transforming it from a desirable destination to a dystopian landmark that evokes broader worries about the future of urban America.

Winners and Losers in the Retail Reorganization

While San Francisco Centre faced collapse, nearby Union Square has attracted new retailers, including Nintendo and Pop Mart with its trendy Labubu dolls. Some luxury brands, like Rolex, have opted to relocate to prestigious addresses around Union Square rather than abandoning the city entirely.

Discount retailer Ross has opened across from the failing mall, illustrating how different segments of the retail market respond to urban challenges.

Market Speculation About the Future

Real estate investors are keeping a close eye on the postponed foreclosure auction after multiple delays. Speculation about the future ranges from total demolition to conversion into mixed-use developments, despite considerable legal and structural challenges ahead. The eventual sale price will be a clear indicator of whether investors see potential in downtown San Francisco.

Consumer Adaptation Strategies

Savvy shoppers are adjusting strategies by gravitating towards revitalized retail options in Union Square or suburban malls like Stonestown Galleria. For essential purchases, many now rely on local stores, online deliveries, or quick trips to discount retailers rather than offering patronage to struggling downtown shops.

Lessons for America’s Urban Future

The collapse of San Francisco Centre offers critical insights for cities across the U.S. grappling with similar challenges. An interplay of remote work, rising retail crime, and shifting consumer preferences has created a perfect storm that local leaders must proactively address. By adapting retail policies and tackling safety issues, cities can mitigate the risk of similar staggering failures in their downtown areas.

The New Reality of American Retail

This $1 billion loss goes beyond the fate of a single mall; it signifies the conclusion of an era in American retail and urban development. The repercussions are felt across commercial mortgage markets, municipal budgets, employment trends, and cultural attributes of prosperity.

As cities nationwide confront parallel dilemmas, San Francisco Centre serves as both a cautionary tale and a catalyst for reimagining urban retail in an evolving post-pandemic world.