Tesla confronts a pivotal moment as it unleashes an array of buyer incentives aimed at averting a second straight annual sales drop. After 2024 marked the company’s first year-over-year delivery decline, Tesla must deliver approximately 555,000 vehicles in the final quarter of 2025 to match the prior year’s total of 1.79 million units.

Wave of Buyer Incentives

Tesla has intensified its promotional efforts across North America, Europe, and China to draw in shoppers. The lineup includes 0% APR financing for up to 72 months on select Model 3 and Model Y models in the United States, alongside $0 down lease options that eliminate thousands in upfront costs. These measures target budget-minded buyers seeking lower monthly payments.

Inventory vehicles come with complimentary premium upgrades, such as specialized paint, larger alloy wheels, and white interiors, worth up to $1,500 per car. The goal is to clear lots of unsold stock before year-end. Buyers taking delivery of new inventory by December 31 also receive three months of free Supercharging and access to Full Self-Driving (Supervised) software.

Gasoline vehicle owners face targeted outreach: trading in a conventional car for a Tesla earns 2,000 miles of free Supercharging, underscoring the fuel savings of electric driving. In higher-end Model S and Model X segments, some markets feature extended or lifetime Supercharging perks.

Global Expansion of Promotions

The campaign extends beyond the U.S., adapting to regional pressures. European buyers see deeper cash discounts paired with free Supercharging periods. In China, Tesla blends price reductions and financing deals to counter fierce local rivals.

These offers represent a step up from typical year-end tactics, reflecting urgency amid softening demand. Analysts attribute the push to broader market shifts, including new Chinese models and affordable alternatives that challenge Tesla’s pricing power.

The Quarterly Sales Hurdle

At the core lies a record-breaking target: 555,000 deliveries in Q4 2025, surpassing any prior quarter. This follows 2024’s 1.79 million total, a 1.1% dip from 2023’s 1.81 million, despite a strong Q4 of nearly 496,000 units. The decline snapped a decade of growth that propelled Tesla to EV leadership.

Competition and Demand Pressures

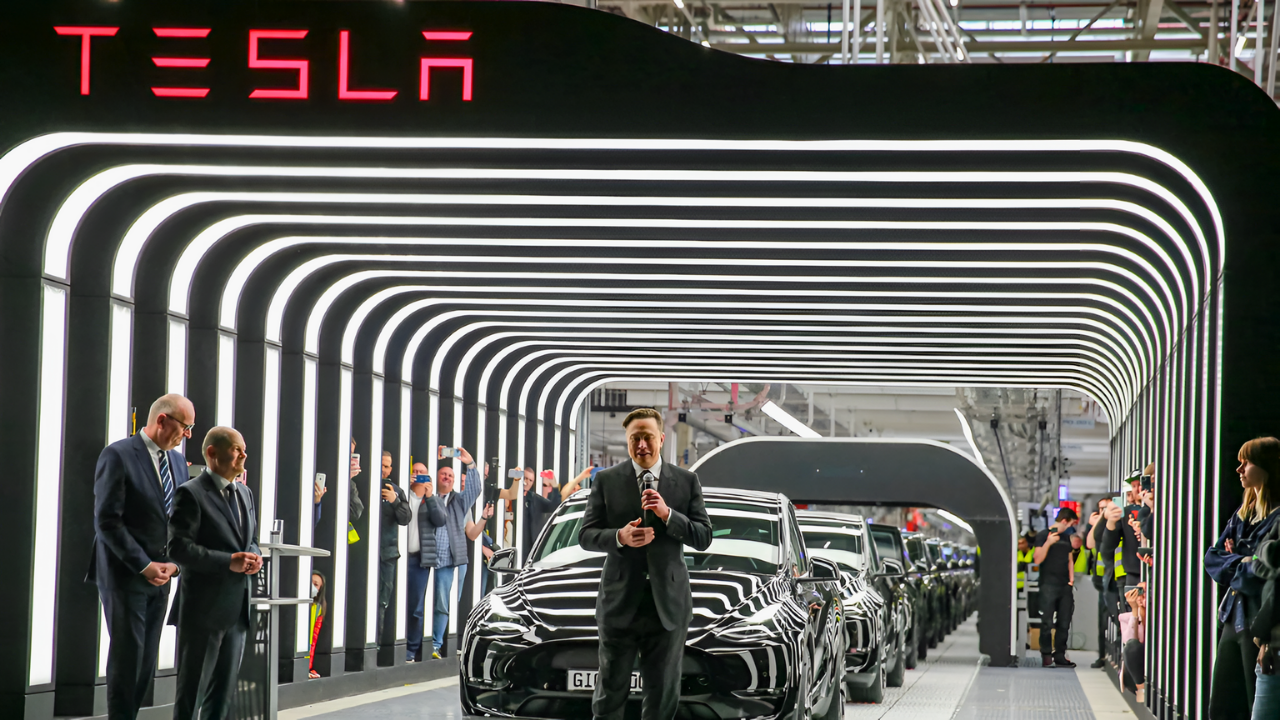

Slower demand growth and a crowded field explain the discounts, not an EV market collapse. Price-sensitive segments now offer more options from rivals, eroding Tesla’s edge. Meanwhile, CEO Elon Musk emphasizes future bets like the Cybercab robotaxi and Optimus robot, yet these provide no immediate relief for automotive sales.

Investors watch closely, wary of margin erosion from zero-interest loans, free upgrades, and software trials—echoing 2024’s price cuts. Persistent discounting could signal the end of effortless volume gains, heightening scrutiny on profitability.

Buyer Opportunities and Future Stakes

Shoppers stand to gain from historic terms: slashed financing, no down payments, and perk bundles unavailable during the EV surge. Yet Tesla’s trajectory hinges on this quarter. Failure to exceed 2024 levels would confirm two years of decline, raising questions about sustained growth amid rivals’ advances and economic headwinds. Success could stabilize shares and reaffirm core business strength, while underscoring the high bar for innovation ahead.

Sources:

“Tesla Fourth Quarter 2024 Production, Deliveries & Deployments.” Tesla Investor Relations, 2 Jan 2025.

“Tesla Offers New Deals As It Races to Avoid Another Sales Decline.” Business Insider, 13 Dec 2025.

“Tesla annual deliveries fall for first time as incentives fail to stoke demand.” Reuters, 2 Jan 2025.

“Tesla Launches New Buyer Incentives: Free Upgrade, 0% APR, $0 Down Leases.” Not a Tesla App, 7 Dec 2025.