BTS’s highly anticipated comeback after nearly four years of mandatory military service has fans buzzing worldwide. Yet excitement is tinged with frustration, as soaring ticket prices and strict presale rules spark controversy across the global fanbase. The 2026-2027 world tour, expected to exceed $1 billion in revenue across 79 shows, underscores the group’s unprecedented commercial power while highlighting tensions over access and affordability in live music.

As one fan noted on social media, “It’s amazing to see them back, but the prices make it feel out of reach.” With a new album “Arirang” set to release on March 20, 2026, the stakes are high. Here’s what’s happening as BTS prepares to take the world by storm.

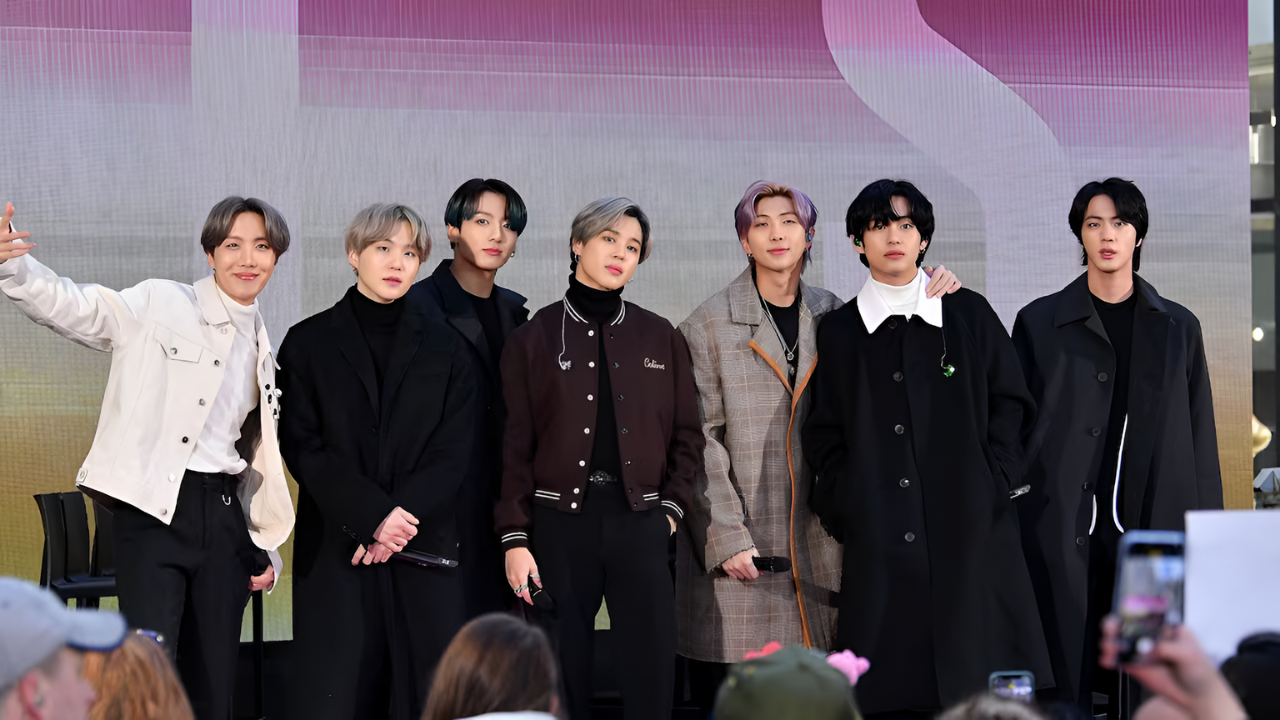

The Long Wait Ends

All seven BTS members—RM, Jin, Suga, J-Hope, Jimin, V, and Jung Kook—completed their 18-to-21-month military obligations by June 2025, with Suga finishing last after alternative social service. Their previous full arena tour ended in 2019, leaving HYBE struggling during the band’s absence. In 2024, the company reported a nearly 37.5 percent drop in operating profit, citing BTS’s hiatus as a key factor, according to the Economic Times. The group’s return is therefore pivotal, not just culturally but financially.

On January 13, 2026, BigHit Music announced the tour: 79 shows across 34 markets in 23 countries, spanning five continents from April 2026 to March 2027. The announcement confirmed plans for a new album, “Arirang,” with pre-orders opening the same day. The scale of the tour reflects both BTS’s global influence and HYBE’s determination to recapture lost momentum, setting the stage for one of the most ambitious comebacks in music history.

Tour Design and Revenue Projections

The tour kicks off April 9 in Goyang, South Korea, featuring 28 North American shows in cities including Tampa, Las Vegas, Stanford, and Los Angeles. A 360-degree in-the-round stage design promises full immersion, allowing fans to surround the performance area. With stadiums holding approximately 60,000 fans nightly, total attendance is projected at 4.7 million worldwide.

Financial analysts estimate $1.05 billion in total spending from tickets, merchandise, albums, and streaming, averaging $12.6 million per show, according to Billboard. Merchandise alone could bring in $200-400 million, while album sales may hit $80 million and streaming $33 million. Local economies along the tour route are also set to benefit from increased hotel bookings, restaurant traffic, and transportation spending, reinforcing BTS’s enormous impact both on the music industry and the communities hosting the shows.

Presale Rules Stir Backlash

Presales opened January 22 exclusively for ARMY Membership holders registered on Weverse by January 18, requiring a 9-digit code beginning with “BA” and active membership status. U.S., Canada, and Mexico fans needed U.S. or Global memberships, while Europe required Global membership. General sales followed January 24 via Ticketmaster, SeatGeek, and regional platforms.

This two-tier system prompted criticism over fairness and accessibility. Non-members faced longer queues, heightened bot risks, and rapid sellouts, while regional rules and registration deadlines added confusion. Many fans described the structure as a de facto paywall, especially challenging for casual followers, teenagers without cards, and fans in developing regions. Combined with HYBE’s prior experiments with dynamic pricing, these policies have sparked petitions and social campaigns urging more equitable ticketing.

Premium Pricing Draws Criticism

Ticket costs for BTS’s comeback are among the highest in K-pop history. In Goyang Stadium, soundcheck seats are 264,000 KRW ($179 USD), General R 220,000 KRW ($149), and General S 198,000 KRW ($134), far above typical $50-120 ranges. North American shows are projected at $150-200 on average, with premium seats reaching $300-500.

Fans also noted that roughly 50% of Goyang seats were labeled “restricted view,” despite the 360-degree stage design. HYBE explained that equipment and stage structures create unavoidable sight-line issues, with views varying depending on artist positions. Online reactions combined frustration over high costs with acknowledgment that shows would sell out regardless, highlighting tension between fan loyalty and perceived value for money.

Industry Implications and Fan Loyalty

HYBE has largely stayed silent amid backlash, betting on sustained demand despite complaints over merchandise and ticket pricing. Membership presales, dynamic pricing, and tiered systems reflect broader industry trends, occurring alongside regulatory scrutiny. In May 2025, the U.S. Federal Trade Commission required upfront disclosure of total ticket costs to reduce “junk fees,” while states proposed resale price caps.

For HYBE, BTS’s comeback carries broader stakes. The band’s revenue share within the company dropped from roughly 95% to under 20% in 2024 as HYBE expanded its roster, according to Music Business Worldwide. As The Independent noted on January 14, 2026: “For HYBE, the comeback comes after several years of heavy investment aimed at reducing reliance on a single act.” This tour will test fan loyalty against rising costs, shaping expectations around transparency and access in global live music.

Sources

How to Get Tickets to BTS’s World Tour From 2026 to 2027. ELLE Magazine, January 16, 2026

The Eye-Watering Numbers Behind BTS’s Marathon Comeback Tour. The Independent, January 15, 2026

BTS The 5th Album Release and World Tour Announcement. BigHit Music Weverse, January 16, 2026