Electric vehicle (EV) sales are experiencing significant growth across the country, with General Motors (GM) holding the second-largest market share in the American EV sector.

The company has succeeded remarkably, doubling its electric vehicle sales in the past year. However, recent developments indicate potential challenges in the luxury electric vehicle manufacturing segment that could impact the industry’s future.

Market Paradox

General Motors has seen strong growth in electric vehicle sales, but luxury models priced over $100,000 struggle to attract consumers.

This challenge prompts automakers to rethink their manufacturing strategies to adapt to market demands.

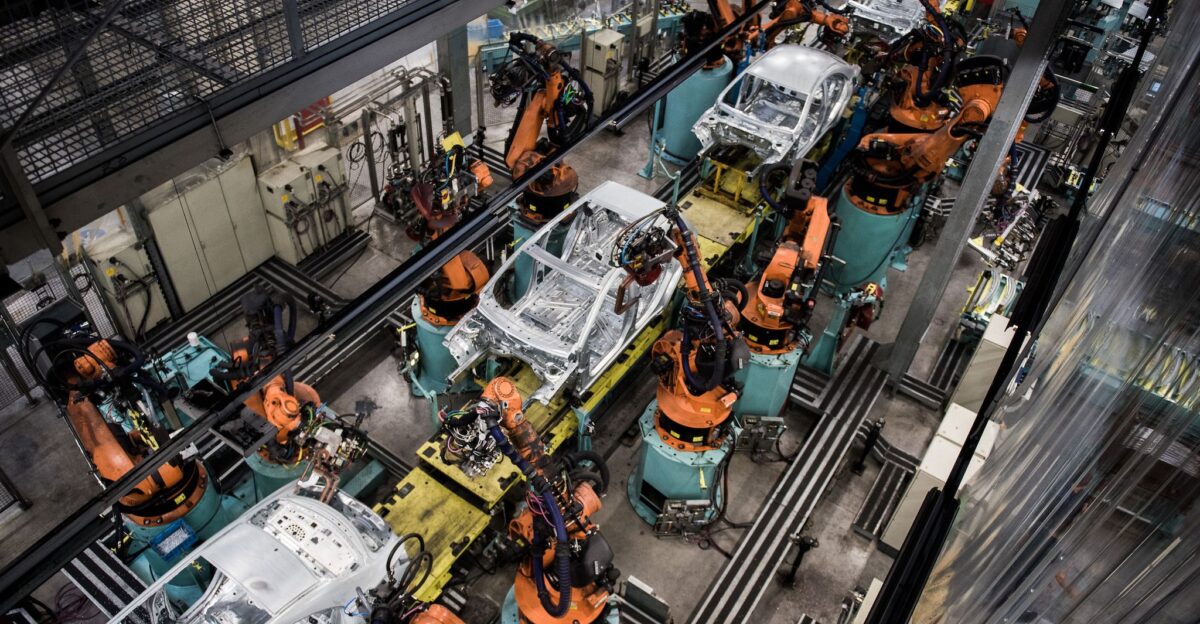

Factory Legacy

Detroit’s Factory Zero, opened in 1985, has produced over four million vehicles, including Cadillac Eldorados and Chevrolet Impalas.

Recently, General Motors transformed the facility into America’s first fully dedicated electric vehicle assembly plant, highlighting a commitment to sustainable manufacturing.

Investment Stakes

General Motors has invested $2.2 billion to transform Factory Zero into a key electric vehicle production facility.

Originally projected to employ over 2,200 workers at full capacity, the facility requires even more staff across multiple shifts and is central to GM’s zero-emissions strategy.

Production Halt

On August 27, 2025, General Motors announced a temporary production shutdown at Factory Zero starting September 2, which will impact the manufacturing of the GMC Hummer EV and the Cadillac Escalade IQ until October 6.

According to GM spokesperson Kevin Kelly, the decision to adjust production at Factory Zero is intended to better align with current market dynamics.

Michigan Impact

The Factory Zero shutdown will temporarily affect 360 workers in the Detroit area, resulting in layoffs.

CBS Detroit reports that these employees may receive supplemental pay and benefits under the GM-UAW national contract during the production pause.

Worker Benefits

Laid-off workers can access unemployment benefits and healthcare during the shutdown.

The GM-UAW National Agreement offers supplemental unemployment pay to assist them financially while production is halted at the Detroit facility.

Competitor Context

General Motors has suspended production of its luxury electric vehicles, highlighting challenges in the industry. According to TechCrunch, Ford’s F-150 Lightning leads electric truck sales with 5,842 units sold in Q2 2025, while the GMC Hummer EV sold 4,508 units.

However, F-150 Lightning’s sales mark the lowest quarterly total in over a year, suggesting a decline in demand for electric trucks.

Luxury EV Crisis

The demand for premium electric vehicles priced over $100,000 is consistently declining worldwide. According to the South China Morning Post, Chinese luxury EV manufacturers are also beginning to slow down their new model releases.

Analysts predict automakers may focus on enhancing and upgrading existing models instead of introducing new ones.

Tax Credit Cliff

Federal EV tax credits of up to $7,500 for new vehicles will expire on September 30, 2025. Car and Driver notes that this deadline may create urgency among buyers, but could lead to a significant decline in demand afterward.

Also, GM’s planned production halt may further impact vehicle availability.

Dealer Frustration

Cadillac dealers report challenges with the Escalade IQ’s $129,900 starting price, nearly $40,000 above the gasoline version.

Top Gear highlights how the high pricing creates market resistance. Dealers now face uncertain delivery timelines for customers who placed orders before the halt.

Leadership Response

GM CEO Mary Barra previously served as plant manager at the Detroit-Hamtramck facility. Her experience gives her unique insight into the factory’s operations.

The production adjustment represents a strategic shift from volume-focused to demand-responsive manufacturing under her leadership.

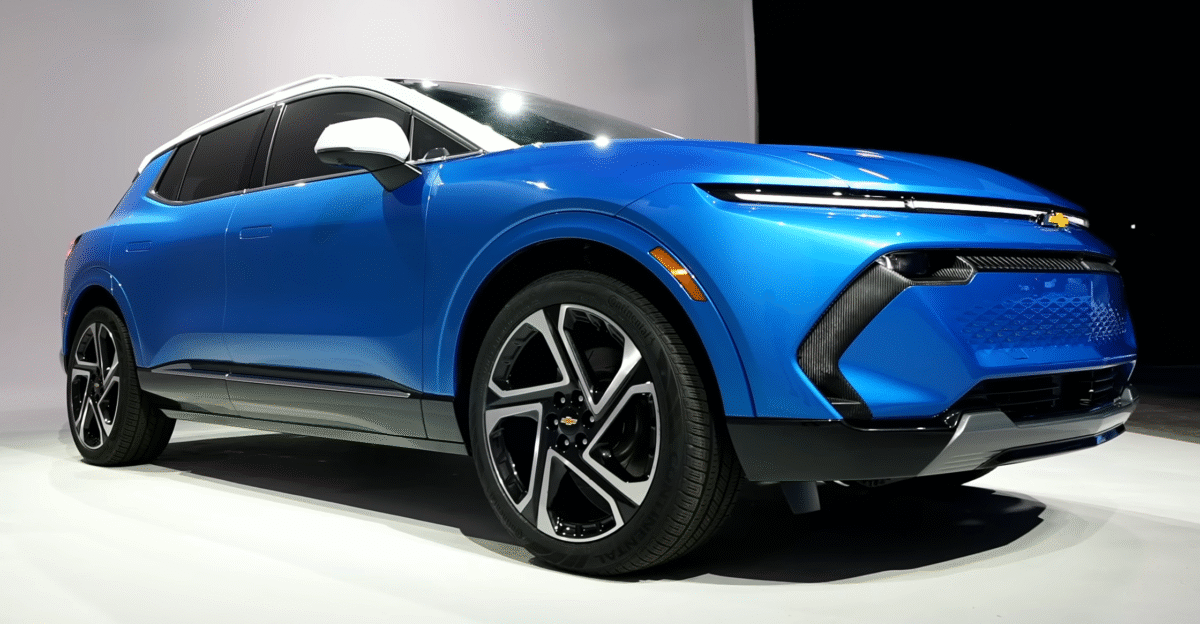

Recovery Strategy

General Motors is shifting its focus toward more affordable electric vehicles, like the $34,995 Chevrolet Equinox EV. GM Authority reports that this model sold 17,420 units in the second quarter of 2025.

The company’s strategy emphasizes volume models over luxury flagships for sustainable growth.

Expert Outlook

Industry analysts question whether the EV demand plateau represents a temporary or permanent change.

EY research indicates global electric vehicle growth slowed from 65% in 2022 to 9.6% in early 2024. Experts warn that luxury EV markets are particularly difficult to expand.

Future Questions

Can GM’s luxury electric vehicles survive without federal tax incentives after September 30?

The Factory Zero shutdown raises questions about whether premium EV demand justifies massive manufacturing investments. The industry is approaching a post-subsidy reality that could completely reshape consumer buying patterns.

Policy Implications

Federal policy changes accelerated EV tax credit expiration from 2032 to September 2025, creating uncertainty for buyers.

Michigan’s electric vehicle manufacturing future depends on continued government support, as state officials negotiate tax agreements tied to employment levels exceeding specific workforce targets at facilities.

Global Ripples

China’s luxury EV segment faces similar demand challenges, representing only 10% of total electric vehicle sales.

Industry reports suggest the global luxury EV slowdown reflects structural market issues beyond regional policy changes, affecting manufacturing strategies worldwide as companies reassess positioning.

Environmental Stakes

GM’s Factory Zero represents $2.2 billion in zero-emissions infrastructure now partially idle.

The production halt challenges the automaker’s environmental goals of zero crashes, zero emissions, and zero congestion, as luxury EV adoption proves slower than anticipated for meeting climate targets.

Consumer Shift

Mainstream buyers prioritize value over premium features, forcing automakers to recalibrate luxury EV strategies.

Industry analysis reveals that the Factory Zero shutdown symbolizes broader recognition that early adopters alone cannot sustain premium EV growth, requiring fundamental shifts in pricing strategies.

Reality Check

GM’s production halt at its most advanced facility signals that even successful automakers must adapt to market realities.

The temporary shutdown may preview permanent changes in luxury EV manufacturing and marketing, as the industry transitions from growth projections to demand-responsive production strategies.