Netflix offered $27.75 per share for Warner Bros. Discovery. Paramount Skydance returned with $30 per share, all cash, backed by billionaire Larry Ellison’s personal guarantee. The Warner Bros. Discovery board still said no.

On January 12, 2026, Paramount headed to the Delaware Chancery Court, arguing that shareholders deserve to know why a simpler, richer offer was rejected in favor of Netflix’s complicated, $82.7 billion cash-and-stock deal.

How Netflix’s Deal Reshapes Warner Bros. Discovery

Under the Netflix agreement announced in December 2025, the streamer would acquire Warner Bros.’ film studio, HBO, Max, and DC Entertainment in an $82.7 billion transaction. WBD’s cable networks, including Discovery Channel, TLC and Animal Planet, would be spun into a separate public company.

Netflix gets the high-growth streaming and studio assets. Existing WBD investors keep stock in a legacy cable business facing cord-cutting and slower growth.

The Spinoff That Makes Shareholders Nervous

Paramount argues the planned Discovery Global cable spinoff is the hidden weak point. In a January 12 letter, David Ellison said WBD has not explained how it valued this “stub equity,” or how much debt will be loaded onto it.

He warned that WBD can decide the debt mix after the Netflix deal is signed, potentially leaving shareholders with a smaller, heavily burdened cable company while Netflix walks away with the crown jewels.

A Cleaner, Higher Cash Offer

Paramount is offering $30 per WBD share, all cash and fully financed. Netflix’s proposal combines $23.25 in cash with $4.50 in Netflix stock, for $27.75 per share. Paramount points out that its bid is approximately 8 percent higher, representing a $2.25-per-share premium that could translate into roughly $6 billion in additional value for shareholders.

The company says the choice is simple on paper: more money, fewer moving parts, no exposure to an uncertain spinoff.

The Personal Guarantee That Didn’t Move the Board

Warner Bros. Discovery initially questioned whether Paramount truly had the financing. In response, Paramount amended its offer on December 22, 2025. According to Paramount’s filings, Larry Ellison signed an irrevocable personal guarantee covering $40.4 billion of equity financing, effectively putting his own fortune behind the deal.

Paramount says that removed the board’s main concern. Even so, WBD’s directors unanimously rejected the offer on January 8, calling it inferior to Netflix’s.

A Rejection Without Real Negotiation

Paramount’s lawsuit leans heavily on how the board handled the process. The company states that WBD never traded contract drafts, never asked detailed questions about financing terms, and never seriously engaged after Paramount’s initial approach on December 4.

From Paramount’s perspective, the December 22 improvements, including the personal guarantee, were brushed aside within days. That, Ellison argues, suggests a board determined to stay with Netflix regardless of the price, rather than one that tests both options rigorously.

Taking the Fight Directly to Shareholders

To bypass the board, Paramount launched a tender offer in December 2025. WBD investors can submit their shares directly to Paramount at $30 each until January 21, 2026. Paramount describes this as giving more than a million individual and institutional holders a direct voice.

If enough shares are tendered, Paramount could gain control without board approval, turning what began as a boardroom decision into a broad shareholder referendum on value and trust.

A Proxy Battle for the Boardroom

At the same time, Paramount is preparing for a proxy fight. In his January 12 letter, Ellison said Paramount intends to nominate its own slate of directors for election at WBD’s 2026 annual meeting. Those candidates, if chosen by shareholders, would be expected to re-examine the Netflix transaction and exercise any contractual rights WBD has to engage with Paramount’s bid.

The advance-notice window for nominations opens within weeks, adding another deadline to an already crowded calendar.

Do Shareholders Know Enough?

The Delaware lawsuit centers on disclosure. Under Delaware corporate law, boards are required to provide shareholders with complete and accurate information prior to major votes. Paramount says WBD has not explained how it valued the cable spinoff, how deal debt is allocated, how Netflix’s “effective” per-share price changes under different scenarios, or what risk adjustments were applied to Paramount’s higher bid.

Ellison argues that without these details, investors cannot make a fair comparison between the two paths they are being asked to choose from.

Confident but Cautious

Warner Bros. Discovery has dismissed Paramount’s claims as “meritless” and a “last-ditch” tactic. In public statements, the company has defended the Netflix agreement as the superior choice, highlighting Netflix’s scale, streaming experience, and perceived regulatory advantages.

Executives argue that Paramount’s proposal carries greater execution and timing risk, despite the higher headline price.

Why Netflix’s Structure Appeals to the Board

From WBD’s point of view, Netflix offers something beyond price: a partner that already leads the global streaming market. The board has emphasized Netflix’s operational track record, suggesting it can better integrate HBO, Max, and Warner Bros. studios into a single global platform.

Directors also appear to believe regulators will look more favorably on Netflix, which has no existing studio, than on Paramount, another major media conglomerate.

Regulators and the Shape of Streaming Power

Both deals will face antitrust scrutiny. If Netflix succeeds, it would combine its roughly 280 million subscribers with WBD’s Max platform, creating an enormous footprint in premium streaming. Some analysts expect regulators to scrutinize that concentration closely.

Others note that Netflix is buying into studios and channels it does not already own. Paramount, by contrast, already runs a major studio and streaming service.

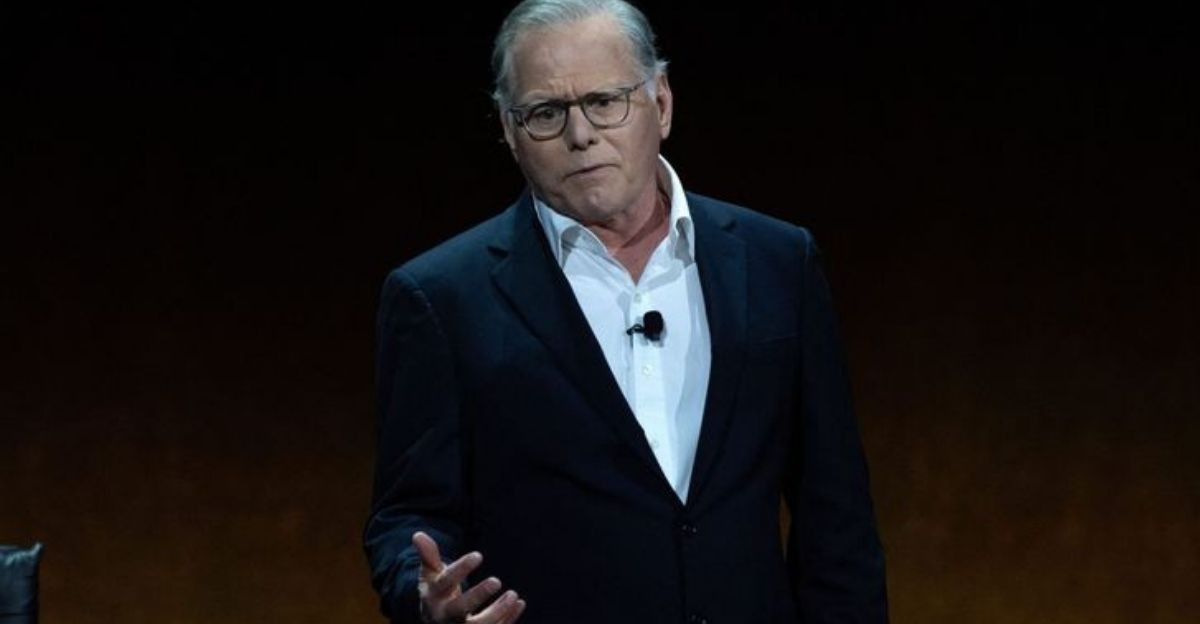

David Zaslav’s High-Stakes Endgame

For WBD Chief Executive David Zaslav, the moment is deeply personal as well as financially significant. According to reports from financial outlets, at Netflix’s $27.75-per-share price, his existing shares and awards could be worth around two-thirds of a billion dollars, pushing his net worth above $1 billion.

A successful $30-per-share sale to Paramount would be even more lucrative. Either path likely ends his tenure atop WBD.

What It Means for Viewers and the Industry

Behind the financial engineering, viewers face their own questions. A Netflix–WBD combination could place HBO originals, DC movies, and Warner Bros. franchises within the Netflix app, reshaping viewing habits worldwide.

A Paramount-led takeover could lead to a different kind of integration, potentially strengthening Paramount+ and unifying more traditional studio assets.

The Choice Ahead for Shareholders

Over the coming months, WBD investors will weigh more than headline numbers. They will consider whether the board has been transparent enough, whether Netflix’s strategic logic outweighs Paramount’s extra cash, and how much regulatory and execution risk they are willing to accept.

Court decisions in Delaware, tender results, and a proxy vote will all feed into a single story: who ends up owning one of Hollywood’s most storied libraries, and on whose terms that future is written.

Sources

Paramount Skydance Corporation Letter to Shareholders, January 12, 2026

Warner Bros. Discovery Board Statement, January 8, 2026

Netflix Acquisition Agreement Announcement, December 5, 2025

Delaware Chancery Court Paramount Skydance v. Warner Bros. Discovery Lawsuit Filing, January 12, 2026

Reuters, Bloomberg, CNBC, Variety Deal Coverage, December 2025–January 2026