The rollout was barely underway when the backlash hit.

Just weeks after WWE’s much-touted ESPN partnership went live in August 2025—touted as seamless access for existing subscribers—fans began spotting unexpected charges on their accounts. Social media lit up with complaints almost immediately.

Now, a federal lawsuit is challenging the deal itself, raising questions that neither company anticipated. What went wrong so quickly after such a confident launch?

The $1.6 Billion Question

WWE inked a five-year, $1.6 billion streaming agreement with ESPN in 2025—a massive upgrade from its previous Peacock deal worth $180 million annually.

The arrangement promised to make WWE’s premium live events the exclusive U.S. home on ESPN’s platforms starting in September 2025. Industry observers hailed it as a watershed moment for professional wrestling’s mainstream legitimacy.

But the rollout exposed cracks in the marketing messaging that now threaten the entire partnership’s credibility.

The Cable Subscriber Trap

For decades, cable and satellite subscribers bundled ESPN as part of their TV packages. When ESPN launched its direct-to-consumer streaming app, the company promised seamless authentication for existing pay-TV customers.

Major carriers like DirecTV and Spectrum quickly signed on. However, other major providers—Comcast Xfinity, YouTube TV, and Cox—lagged in negotiating authentication agreements.

This fragmentation created a two-tier system that confused millions of fans.

Marketing Promises Collide with Reality

In August 2025, WWE President Nick Khan appeared on The Varsity podcast and made a bold claim: “You subscribe to that product, you get WrestleMania, SummerSlam, Royal Rumble, all of our other premium live events, with no upcharge.”

ESPN’s official press release echoed this message, stating features would be “available to all fans who watch on the ESPN App on mobile and connected TV devices, whether they subscribe directly or through a traditional pay TV package.”

These statements set expectations that would soon shatter.

The Lawsuit Lands

On January 8, 2026, a federal class action lawsuit was filed in the U.S. District Court in Connecticut against WWE, alleging deceptive marketing practices.

Plaintiffs Michael Diesa of New Jersey and Rebecca Toback of New York claim they were misled into paying $29.99 monthly for ESPN’s standalone app despite already subscribing to ESPN through cable and streaming services.

The suit seeks more than $5 million in damages on behalf of all similarly affected U.S. customers who paid between August 6 and September 20, 2025.

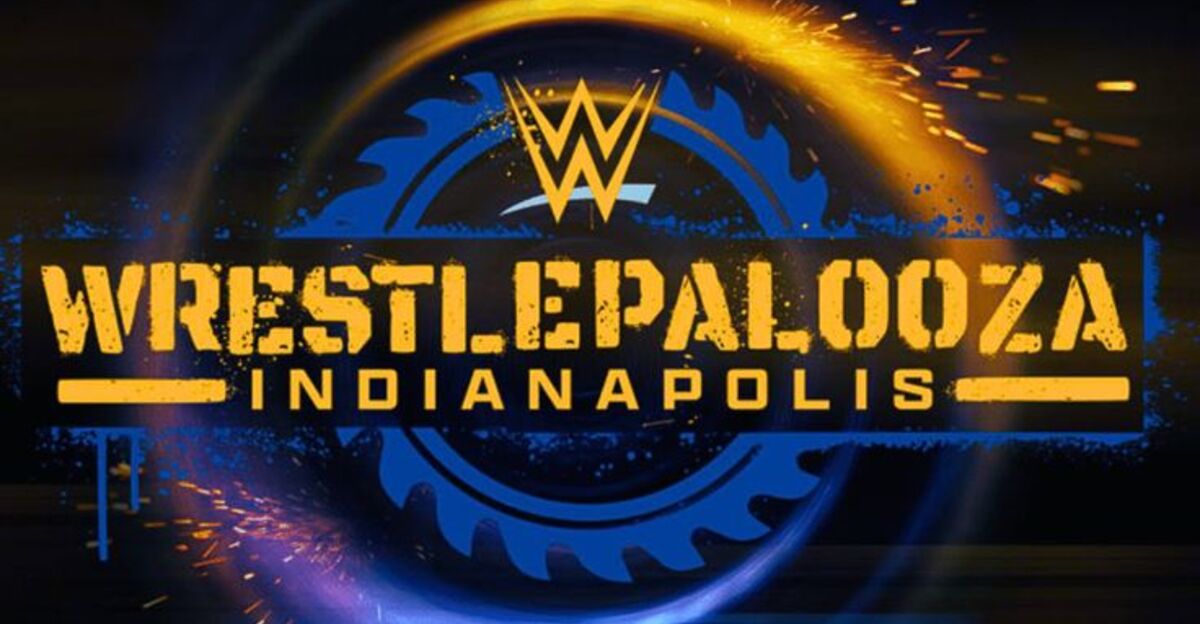

Ground Zero: Wrestlepalooza

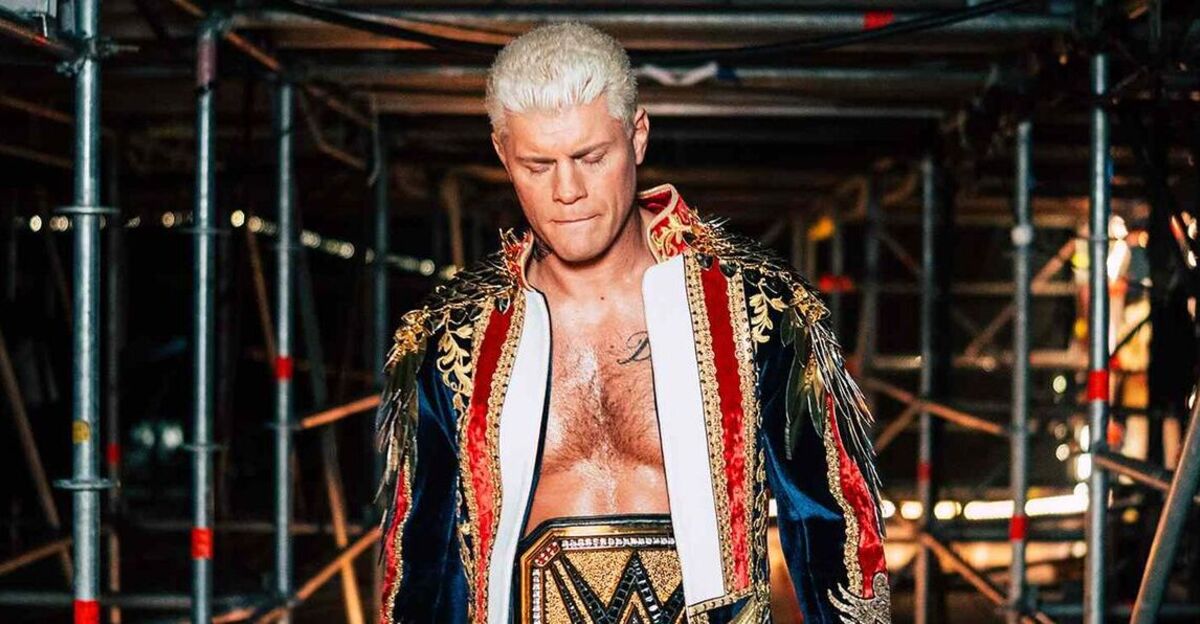

September 20, 2025, marked WWE’s debut on ESPN with Wrestlepalooza, a premium live event featuring John Cena vs. Brock Lesnar, CM Punk and AJ Lee vs. Seth Rollins and Becky Lynch, and Cody Rhodes defending the Undisputed WWE Championship.

For many fans, the event became a painful lesson in fine print.

Those whose cable providers hadn’t yet signed authentication agreements with ESPN discovered they couldn’t simply log in with their existing credentials. Instead, they faced a paywall: $29.99 per month for ESPN Unlimited, the standalone streaming service.

Unwilling Participants

Michael Diesa, an Xfinity cable subscriber paying approximately $116 monthly for cable that includes ESPN, upgraded his Disney+ plan on August 22, 2025, to a bundle including ESPN Unlimited so his nine-year-old son could watch WWE events.

Rebecca Toback, a YouTube TV subscriber paying $82.99 monthly, faced the same dilemma. Both believed their existing ESPN access would suffice.

Instead, they became unwilling participants in what the lawsuit characterizes as a “bait and switch” scheme orchestrated by WWE and ESPN.

The Authentication Patchwork

ESPN had negotiated authentication agreements with some major carriers but not others by September 2025. DirecTV, Verizon FIOS, Spectrum, Hulu + Live TV, and Fubo TV customers could log into the ESPN app using their existing credentials and watch WWE events at no extra cost.

However, Comcast Xfinity, YouTube TV, and Cox customers faced barriers.

This fragmented rollout created a confusing landscape where identical ESPN subscriptions yielded vastly different access levels depending on the provider.

Industry Ripple Effects

The lawsuit raises broader questions about how streaming partnerships are marketed to consumers. Competitors, including Netflix, Amazon Prime Video, and traditional cable networks, face similar authentication challenges as they expand direct-to-consumer offerings.

Regulatory bodies and consumer protection agencies are increasingly scrutinizing deceptive streaming practices.

The WWE case could set a precedent for how sports leagues and entertainment companies communicate access terms to subscribers across fragmented distribution channels.

The Strategic Misstep

Plaintiffs strategically named only WWE as the defendant, not ESPN or parent company Disney. This tactical choice aimed to sidestep arbitration and class action waiver provisions embedded in Disney’s subscriber agreements.

However, the move also signals WWE’s vulnerability: the company may struggle to deflect responsibility for marketing claims made by its own president and in its own press materials. Legal experts note that certifying the class itself could become a pivotal battleground.

WWE’s Defensive Position

WWE has not yet filed a formal response to the lawsuit as of mid-January 2026. Industry observers expect the company to argue that ESPN’s carriage agreements and authentication delays—not WWE’s marketing—created the confusion.

WWE may contend that Nick Khan’s podcast comments were aspirational rather than binding promises, and that a SmackDown segment the night before Wrestlepalooza clarified that access would be free for “most big providers.” This defense hinges on parsing language and intent.

ESPN’s Silence

ESPN has not publicly commented on the lawsuit, despite being central to the authentication failures. The company stated it expected to eventually sign deals with all major cable and streaming providers carrying ESPN, which would grant subscribers free access to the ESPN app.

However, this timeline proved optimistic. ESPN’s parent company Disney faces potential reputational damage, though it avoided direct legal liability by not being named as a defendant.

The Numbers Game

Between August 6 and September 20, 2025, WWE content drove an estimated 95,000 to 125,000 signups for ESPN Unlimited, according to the lawsuit complaint.

At $29.99 per month, this translates to roughly $2.8 million to $3.7 million in revenue from the affected class period alone.

Individual refunds would likely total around $30 per person, making this a classic class action scenario where individual damages are modest but aggregate exposure is substantial.

Legal Hurdles Ahead

Certifying the class will require proving that common questions of law and fact predominate over individual issues. WWE may argue that authentication availability varied by provider, making individual circumstances too diverse for class treatment.

The company could also challenge whether Nick Khan’s statements constitute binding corporate promises or merely aspirational commentary.

Courts typically scrutinize whether consumers reasonably relied on specific marketing claims versus general industry puffery.

What Comes Next?

WWE must file a response within weeks, likely including a motion to dismiss or a request for arbitration. Discovery could reveal internal communications about authentication timelines and marketing strategy.

Settlement negotiations may occur before class certification is decided.

The case will test whether sports entertainment companies can be held liable for misleading marketing when third-party platform issues complicate access. The outcome could reshape how streaming deals are marketed industry-wide.

Regulatory Implications

The Federal Trade Commission has increasingly scrutinized deceptive streaming practices, including hidden fees and misleading access claims.

This WWE lawsuit could attract FTC attention as a test case for enforcement against entertainment companies.

State attorneys general in Connecticut, New York, and other jurisdictions may also investigate whether broader consumer protection violations occurred. The case signals growing regulatory appetite to police streaming industry marketing practices.

The Broader Streaming Crisis

WWE’s misstep reflects a systemic problem plaguing the streaming era: fragmented authentication, unclear access terms, and marketing that prioritizes subscriber acquisition over transparency.

Netflix, Disney+, and Amazon Prime Video have all faced similar complaints. International markets, where WWE content airs on Netflix, have largely avoided these issues through clearer licensing structures.

The U.S. direct-to-consumer model’s complexity creates fertile ground for consumer litigation.

Financial Stakes for WWE

WWE’s annual ESPN revenue averages $325 million—a critical component of parent company TKO Group’s valuation and cash flow.

A $5 million judgment would be modest relative to annual revenue but could trigger broader contractual disputes with ESPN. More significantly, reputational damage could complicate future media negotiations.

If the lawsuit succeeds, WWE may face pressure to restructure how it markets streaming access or renegotiate terms with ESPN.

Consumer Trust and the Future

The lawsuit underscores a fundamental tension in modern sports entertainment: the desire to maximize revenue through premium streaming services versus the expectation of broad, affordable access.

Fans who grew accustomed to inclusive cable bundles now navigate a fragmented landscape of apps, authentication requirements, and surprise fees.

WWE’s handling of this transition—and the legal fallout—will influence how other sports leagues approach their own streaming partnerships.

The Reckoning

WWE’s $1.6 billion ESPN deal was intended to elevate the mainstream status of professional wrestling. Instead, it exposed the gap between corporate marketing promises and consumer reality.

The January 2026 lawsuit represents a pivotal moment: will courts hold entertainment companies accountable for misleading access claims, or will they defer to fine-print disclaimers?

The answer will shape not just WWE’s future but the entire streaming industry’s approach to transparency and consumer protection.

Sources:

Post Wrestling – “New lawsuit claims WWE misled fans about ESPN streaming access to PLEs” – January 9, 2026

Awful Announcing – “Lawsuit claims WWE misled fans about PLE access on ESPN” – January 9, 2026

Sports Illustrated – “WWE Facing New Class Action Lawsuit Over ESPN Streaming Deal” – January 10, 2026

Wrestling Inc. – “New Class Action Lawsuit Filed Against WWE Regarding ESPN PLE Deal” – January 8, 2026

Brass Ring Media – “Class action lawsuit or not, the WWE streaming deal with ESPN sucks” – January 9, 2026

ESPN Press Release – “ESPN, WWE Reach Landmark Rights Agreement” – August 6, 2025

CNBC – “ESPN inks five-year deal for WWE’s live premium events” – August 6, 2025