UnitedHealth Group, America’s largest health insurer, is set to disenroll about 1 million seniors from its Medicare Advantage plans for 2026—the biggest single-insurer reduction in more than two decades. The move signals a major disruption for seniors, healthcare providers, brokers, and small businesses nationwide.

Tim Noel, Chief Executive of UnitedHealthcare, said, “Our plan for next year reflects a conservative path focused on margin growth. We made significant adjustments to benefits.” Here’s what’s happening and why this decision could reshape Medicare Advantage.

What’s Driving the Cuts?

Several financial and operational factors prompted UnitedHealth to undertake this unprecedented reduction. The insurer’s Medicare product margins fell from 5.6% in 2024 to just 2.1% in 2025. Its Optum Health Services division saw an even steeper decline, dropping from 8.3% in 2024 to around 1% in 2025. Operational challenges, including a February 2024 cyberattack on Change Healthcare, worsened the situation.

Tim Noel noted rising healthcare costs: “We are witnessing medical costs rise beyond our expectations, especially in outpatient services.” Regulatory pressures also contributed. Bobby Hunter, head of UnitedHealth’s government programs, explained, “The combination of funding reductions from the Centers for Medicare and Medicaid Services, escalating healthcare expenses, and increased service usage has created obstacles.”

How Many Members Are Affected?

The disenrollment will impact roughly 1 million members nationwide. Around 600,000 come from preferred provider organization (PPO) plans, while about 400,000 are expected to switch due to higher prices and reduced benefits. UnitedHealth’s decision primarily affects counties with declining profitability, leaving major metropolitan areas largely untouched.

This scale surpasses those of competitors, such as Humana’s 550,000-member reduction for 2024–2025. UnitedHealth plans to exit Medicare Advantage in 109 counties in 2026, initially affecting 180,000 members. These cuts highlight the growing trend of insurers withdrawing from financially challenging regions while maintaining a presence in profitable urban markets.

Impact on Seniors and Providers

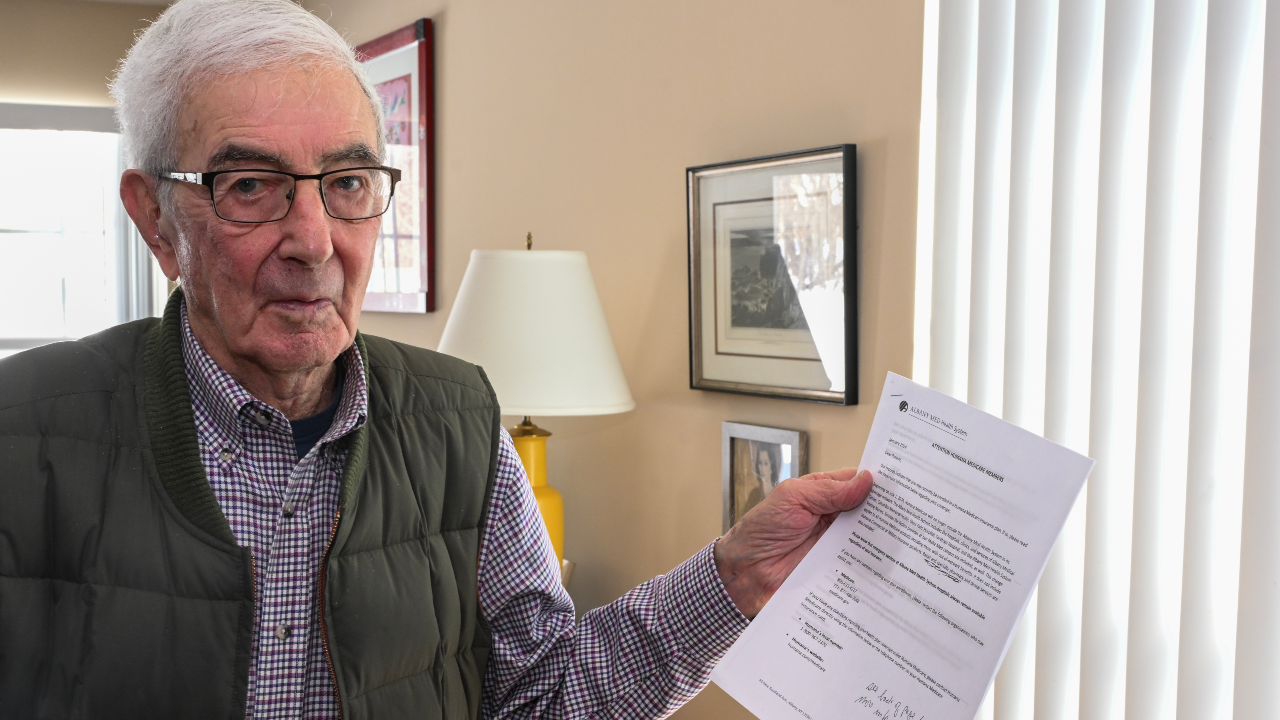

For the seniors losing coverage, the change is immediate and complex. Affected members must identify new plans, navigate potential coverage gaps, and adjust to different provider networks. UnitedHealth is sending notifications with instructions, and CMS has authorized Special Enrollment Periods to ease transitions.

Healthcare providers also face disruptions. Hospitals and clinicians must review or terminate contracts, limiting network options for patients. Institutions that previously left UnitedHealth networks compound these challenges. Insurance brokers are under pressure to help clients select new plans, with smaller agencies being particularly vulnerable to the sudden surge in workload.

Financial Stakes and Industry Implications

Each disenrolled member represents an estimated $12,000–$13,000 in annual government payments, putting up to $12–$13 billion in revenue at risk. CMS quality metrics and stricter reimbursement rules intensify pressure on lower-rated plans, prompting insurers to consider exits.

UnitedHealth’s decision sets a precedent for scale in Medicare Advantage withdrawals. If financial and regulatory pressures persist, other insurers may follow, potentially reshaping access to Medicare Advantage across the nation. Policymakers, providers, and insurers must act swiftly to stabilize coverage and mitigate disruptions ahead of the 2026 enrollment period.

Looking Ahead: What’s Next?

UnitedHealth’s 1 million-member reduction could redefine senior healthcare coverage. Policymakers may need to reassess funding structures, while insurers must navigate tighter margins and regulatory scrutiny. Providers and brokers are preparing for continued operational disruption, highlighting the fragility of specific Medicare Advantage markets.

This large-scale exit may signal a broader trend, highlighting the challenges insurers face in striking a balance between profitability and accessibility. For seniors, it underscores the importance of early planning and careful review of alternative Medicare Advantage options. The coming months will reveal whether this move sparks urgent policy adjustments or represents a lasting shift in the industry landscape.